Auditor's Warning: Pittsfield Approaching Tax Levy Ceiling By Andy McKeever, iBerkshires Staff

03:25AM / Wednesday, March 23, 2016 | |

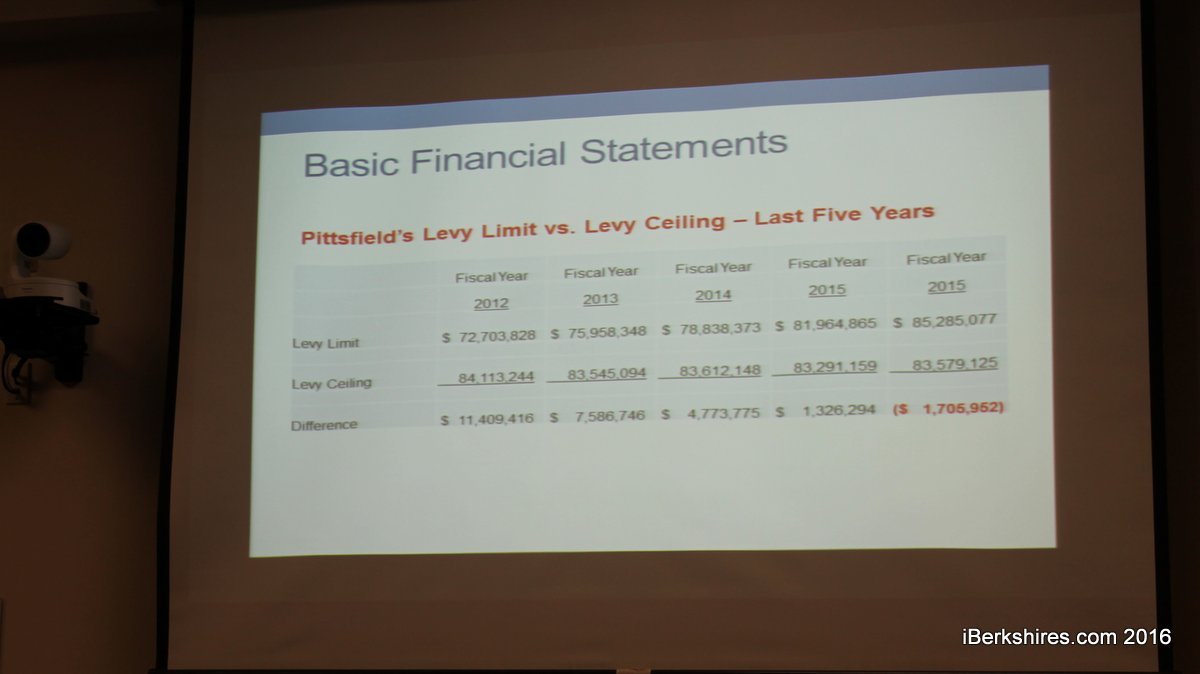

The city's levy capacity from recent years. The city's levy capacity from recent years. |

PITTSFIELD, Mass. — Auditor Thomas Scanlon Jr. says the city's ability to tax will quickly erode over the next few years forcing it to either make significant cuts to the budget.

"You still do have some levy capacity in there but you should be thinking for future budgets," Scanlon told the City Council on Tuesday.

The auditor said there is $6.7 million in taxable capacity in 2016 but that is down from $8.4 million in 2015. In the next budget, close to $3 million is expected to be added because of bonds, shrinking the ability to raise taxes even further. If budgets continue to rise over the next few years, the city will lose its ability to raise taxes any more.

"You are going to be at your levy ceiling," Scanlon said.

The issue was first raised last fall by former Councilor Barry Clairmont. According to Scanlon, there are two state provisions at play — the levy limit and the levy ceiling.

The limit is calculated by adding 2 1/2 percent and calculated new growth to the previous year's levy limit. The ceiling is taking the previous year's total taxable value and multiplying that by 2.5 percent, a restriction in place to ensure that no more than a quarter of the total property values are being taxed.

This year, the ceiling is below the limit, providing a less movable Proposition 2 1/2 restriction — only an increase in total taxable value will raise the ceiling.

"With no growth, you are going to be there for a while. That $6 million, I feel, is going to shrink," Scanlon said.

Ward 1 Councilor Lisa Tully added that if property values decrease, that ceiling gets lower so the difference between the ceiling and the city's ability to tax could close in a hurry.

"In two years time, we could be there," she said.

Scanlon said to raise the ceiling by even $1 million will take the growth of something like a casino, adding multiple millions to the taxable value.

"The strategy isn't as simple as raise values or cut budgets. It is much more complicated than that," Finance Director Matthew Kerwood said. "We need to build reserves and that's a piece of this as well."

Kerwood said he is working with Mayor Linda Tyer on the budget now and is looking for a spending plan that "fosters an environment" for growing property valuations, building that reserve, and "reducing spending where needed."

"We are beginning the budget process so collectively we will be continuing to explore all of these options," Kerwood said.

Scanlon is particularly urging for reserves to be built up and that is mostly focused on the city's bond rating. Scanlon said the excess levy capacity — the $6.4 million the city can raise taxes — is essentially seen as credit or a reserve to bond rating companies. If that levy capacity disappears, that lowers the city's bond rating, he said.

He suggests adding money to a stabilization fund that creates a reserve to protect the bond rating so it isn't impacted as much if, or when, the city hits that levy ceiling.

"You still have that levy capacity but I want you to think about the '17 and '18 budgets," Scanlon said.

The issue was first brought out during the City Council's tax classification hearing. Clairmont, an accountant himself, brought the issue to the council and called for keeping more of the city's certified free cash in the coffers to build reserves. Of the city's $4 million or so in free cash, $2.25 million eyed to be used to offset the tax rate. The City Council ultimately reduced that to $1.5 million. In doing so, that raises the tax rates but builds the reserves. |

MEMBER SIGN IN

MEMBER SIGN IN

MEMBER SIGN IN

MEMBER SIGN IN