Pittsfield's Booming Housing Market Raises City Value by $256MBy Brittany Polito, iBerkshires Staff

04:09PM / Monday, November 08, 2021 | |

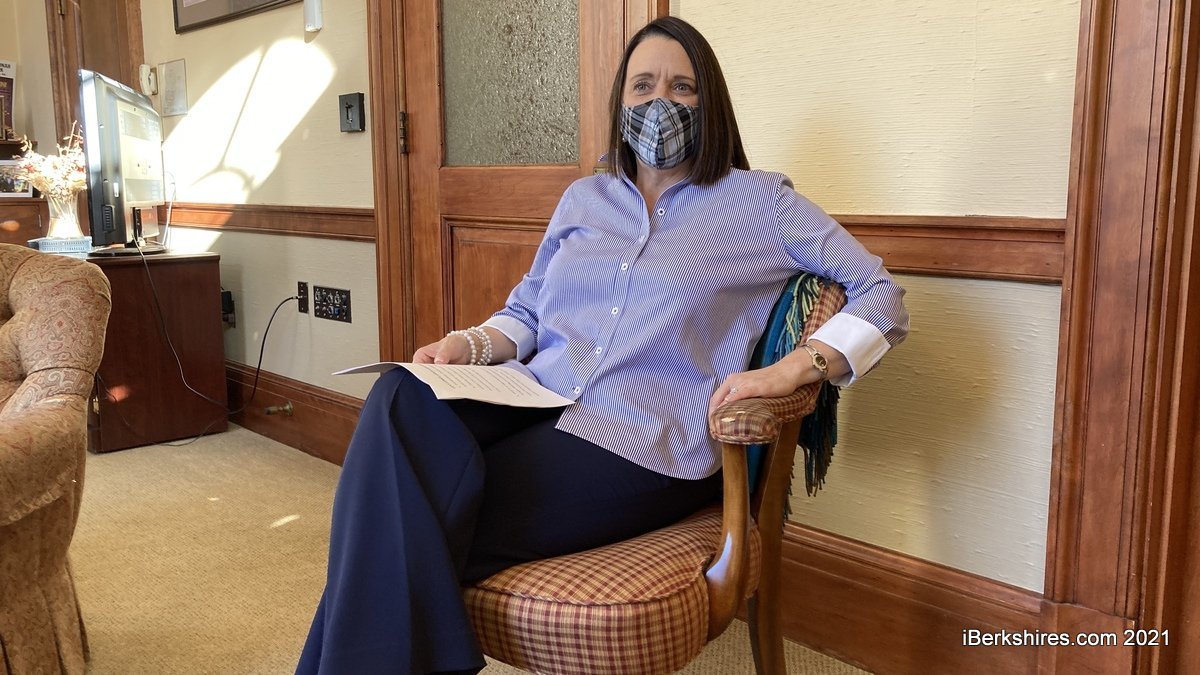

Mayor Linda Tyer says the rise in property values will mean a drop in the tax rate and eases the constraint imposed by the city's levy ceiling. Mayor Linda Tyer says the rise in property values will mean a drop in the tax rate and eases the constraint imposed by the city's levy ceiling. |

PITTSFIELD, Mass. — The average homeowner will their tax rate drop by almost a dollar but their property tax bill will go up about $200 because of rising values.

Mayor Linda Tyer on Monday gave a preview of the presentation to be made at Tuesday night's tax classification hearing that includes news that the city's levy capacity has increased.

The city's levy ceiling is no longer under the constraints of the Proposition 2 1/2 for the first time since fiscal 2015.

"So we've reached a really significant milestone in the city's financial situation," she said, adding, "This is a big step forward for us, and while we could access the city's full levy capacity, we would never do that, but there are other important benefits associated with this."

The Massachusetts law enacted in 1980 puts strict limits on the amount of property tax revenue a community can raise through real and personal property taxes to 2.5 percent of the prior year's levy plus new growth. The levy ceiling, which it cannot go beyond, is 2.5 percent of its full value of real and personal property.

The city will have access to its full levy capacity for FY22 but will not use all of it. A levy of about $94,664,472 is planned to be utilized, leaving about $5.3 million excess levy capacity.

"For example, having this constraint removed enhances our liquidity positions, so that liquidity is what all the bond rating agencies and people who want to purchase our municipal bonds, they're looking for liquidity so that better positions us in the bond rating agencies," Tyer said.

"In addition to liquidity, having this excess levy capacity is another form of revenue reserves, so like free cash is a reserve, stabilization is a reserve, excess levy is also a reserve."

The change this year is because of the $254,625,346 increase in total real and personal property values over fiscal 2021. The primary contributor for this increase are single-family homes that saw a 9 percent increase in total value over the fiscal 2021 amount of $207,030,940.

Tyer will propose a residential tax rate of $18.56 per $1,000 of valuation and a commercial, industrial, and personal property tax rate of $39.90 to the City Council on Tuesday evening.

The average single-family home is now valued at $222,000 because of increased demand during the pandemic, up from $204,000 last year.

With this home value, homeowners can expect to pay about $4,122 in property taxes this year, which represents a $196, or a 5 percent, increase.

If approved, homeowners will see their tax rate decrease about 3.6 percent from $19.25 and the commercial property owners' rate will decrease about a quarter percent from $39.99.

These values use a residential factor of .8029 at a shift of 1.7260, a burden that is taken from residential rates and put to the commercial rate. Pittsfield does not operate as a single tax rate municipality and therefore uses this configuration.

"Each municipality, we start with a single tax rate, and in our case, the single tax rate would be $23.12," Chief Assessor Paula King explained.

"But for communities that have had a larger disparity between the residential sector and their commercial sector, we have the ability to shift some of the burden away from the residential and on to the commercial, industrial personal property, it has been historically for as long as I can remember that Pittsfield has taken the ability to use the shift."

The city has about 19,000 taxable properties within its bounds. Of those properties, about 11,300 are single-family homes.

"We think we're in a really strong position, not only for this year but in the years going forward and it's a nice recovery," Tyer said. "And I guess we could say that this is a COVID-19 silver lining, that we have had in our city, a lot of demand for single-family homes and not a lot of supply, so that's another challenge for us when we think about the growth of our city, especially in our neighborhoods."

King said she anticipates home values to rise, but that doesn't mean that taxes will rise.

"For many people in Pittsfield, their home is their greatest asset, and so you want your asset to have value, not only for your equity but for your future potential sales or for your legacy for your family," Tyer added.

"Having homes with value is important for individual financial stability just as much as it is for community stability."

In Pittsfield, taxes are billed quarterly. The first two bills are called the preliminary bills because they are based on the previous year's bill with a 2 1/2 percent increase. The second two bills are based on the new tax rate.

Tyer said she knows the council will ask hard and understandable questions when this is proposed at Tuesday's meeting as an obligation to their constituents but the administration is well prepared.

"I'm confident that we can persuade them that this is the most pragmatic way for us to first acknowledge the accomplishment of coming out past that constraint, but also, understanding that our homeowners now have some really good values in their homes and that tax rate will be going down,"

"And there's a lot to be proud of in terms of what we've overcome, not only financially but from a public health standpoint, we're on the road to recovery, and I'm confident we can make a case for why this proposal ought to be passed."

|